For one thing so vital, it’s wonderful what number of ladies don’t understand how their credit score rating is calculated. Your credit score rating may very well be the factor standing between you and that mortgage mortgage it is advisable purchase your first dwelling. It would tip the size for or towards you if you apply on your dream job. It would make the distinction between paying 12% or 20% curiosity in your bank cards. In different phrases, your credit score rating issues. That’s why it is advisable perceive how your credit score rating is tabulated and what you are able to do to enhance it.

For one thing so vital, it’s wonderful what number of ladies don’t understand how their credit score rating is calculated. Your credit score rating may very well be the factor standing between you and that mortgage mortgage it is advisable purchase your first dwelling. It would tip the size for or towards you if you apply on your dream job. It would make the distinction between paying 12% or 20% curiosity in your bank cards. In different phrases, your credit score rating issues. That’s why it is advisable perceive how your credit score rating is tabulated and what you are able to do to enhance it.

The Three Credit score Reporting Companies

It’d be good if there was solely a single company that decided your credit score rating however that’s simply not the case. As a substitute, three completely different companies every individually compile a credit score report on you and provide you with a rating:

- Experian

- Transunion

- Equifax

The scores could range by a few factors (typically extra). Luckily, all three companies use the identical standards and weight that standards in an analogous method. Let’s take a look at the 5 issues that may make or break your credit score rating*.

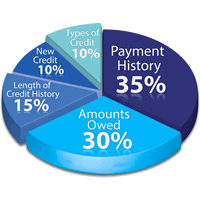

Cost Historical past – 35%

The most important think about figuring out your credit score rating is whether or not or not you repay your loans on time. Meaning paying your hire, making your auto and pupil mortgage funds, and paying at the very least the minimal steadiness in your bank cards.

The best technique to tank your credit score rating is to overlook a fee. As quickly as a fee is 30 days late, a creditor can add a observe to your credit score report.

Enhance – Simply make your whole funds on time. When you can’t totally repay your bank cards, at the very least make the minimal fee. When you can’t make a mortgage fee, don’t simply ignore it. Name the creditor and attempt to negotiate. Many banks will permit prospects to skip one fee a yr or will mean you can make a partial fee.

Quantities Owed – 30%

This refers to how a lot credit score you might be utilizing versus the quantity of credit score you might have out there (generally known as your “credit score utilization ratio”). When you cost $500 on a bank card with a $1,000 line of credit score, your credit score utilization ratio is 50% for that card. The extra debt you cost to your card, the extra probably it is going to damage your credit score.

Enhance – It’s at all times a good suggestion to maintain balances low in your playing cards anyway, so our recommendation right here is to attempt to pay down your bank cards as a lot as doable. (Paying curiosity = throwing away your cash.) Ideally, you wish to attempt to hold under 20% utilization on every particular person card and under 20% utilization of all bank cards mixed. One fast hack is to name your financial institution and ask for the next line of credit score. This can decrease your credit score utilization ratio… so long as you don’t enhance your fees to suit your new allowance.

Size of Credit score Historical past – 15%

The minute you get authorized on your first bank card or begin making funds in your pupil loans, you’ll begin constructing your credit score historical past. The longer you maintain credit score, the upper your credit score rating might be.

Enhance — It’s as least price contemplating getting credit score as early as doable, so long as you may deal with the accountability. You may legally get a bank card at age 18 in the US (although you’ll want to point out proof of revenue).

New Credit score – 10%

Credit score scoring companies will ding your credit score rating should you take out an excessive amount of new credit score in too wanting a time. Watch out when making use of for brand spanking new bank cards, together with retailer bank cards. Saving 10% on a purchase order is good, however is it price decreasing your credit score rating?

Enhance – Typically life simply occurs and it is advisable take out a number of types of credit score in a brief time frame. Concentrate on this issue, and should you can, keep away from opening a number of strains of credit score or taking out loans in the identical yr.

Credit score Combine – 10%

You’d assume that paying off your bank cards in full every month could be sufficient to offer you an ideal credit score rating. Not so quick! Credit score scoring companies need you to point out you could deal with holding various kinds of credit score. This consists of “revolving debt” (bank cards) and “installment loans” (mortgages, auto loans, pupil loans).

Enhance – Youthful of us typically wrestle with this one, since they might merely not have had the chance or must take out a mortgage. One simple method to do that is to take out a mortgage for a brand new furnishings buy that you simply have been already planning to purchase, comparable to a mattress. Often these loans embrace a particular interest-free introductory interval. Do you greatest to repay the mortgage earlier than the interest-free interval runs out, and then you definately’ll get the credit score increase with none additional price!

It’s at all times a good suggestion to examine your credit score stories usually to see how you might be doing (and in order that there aren’t any surprises if you sit down along with your banker to debate a mortgage mortgage). The U.S. authorities lets you request your credit score rating free of charge every year at https://www.annualcreditreport.com/index.action. Many banks additionally let their prospects usually examine their credit score scores free of charge.

Need assistance to enhance your credit score rating? Take into account creating a Money Club with your mates who wish to enhance their funds as effectively!

* Percentages taken from FICO Rating formulation — https://www.myfico.com/credit-education/whats-in-your-credit-score/

Preserve Studying